Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software.

To achieve that, first we need to create an input information for AmiBroker where it could read the trades from. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction (buy or sell), dates and position sizes. A sample input file may look like this:

Symbol,Trade,Date,Price,Shares AAME,Buy,2000-04-06,2.66,375.94 AAME,Buy,2000-04-10,2.66,378.922 AAPL,Buy,2000-04-27,31.23,32.0862 AAON,Buy,2000-04-06,3.19,313.48 ABAX,Buy,2000-04-26,7.67,132.101 AB,Buy,2000-04-25,20.23,50.0337 A,Buy,2000-04-27,84.66,11.8362 AAME,Buy,2000-05-10,2.6,373.627 ABCB,Buy,2000-05-11,6.08,159.406 A,Buy,2000-05-15,82.27,11.736 AAON,Buy,2000-05-18,3.84,246.242 AB,Buy,2000-05-15,20.84,46.3303 ABAX,Buy,2000-05-18,5.84,161.913 ABCB,Buy,2000-05-15,6.08,158.803 AAME,Buy,2000-05-19,2.6,363.763 AB,Buy,2000-06-05,22.78,43.3501 ABC,Buy,2000-05-18,4.49,210.595

We can read and backtest such input with the formula presented below. It is important to remember that this particular code can work with input files of identical format (columns in identical order, signals specified with exact Buy / Sell words, position sizes specified as shares). Changing the input format would also require to update the formula to match the input.

Path to the file is specified in the very first line (note that double backslashes need to be used).

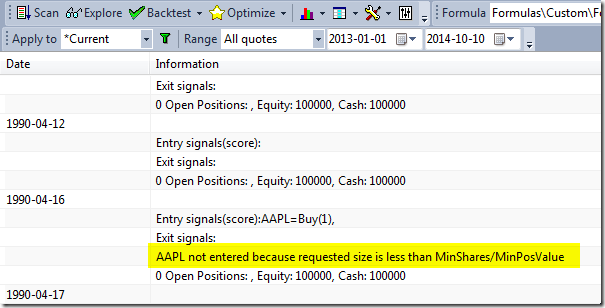

The formula reads the file line by line, then on a bar with matching date/time it generates a new Buy or Sell signal that is then combined with existing signals (coming from other bars).

file = "C:\\TEMP\\trades.csv"; // change this to real location of your data file

dt = DateTime();

//

// Initialize variables

Buy = Sell = possize = 0;

//

fh = fopen( file, "r" );

//

if( fh )

{

while( ! feof( fh ) )

{

line = fgets( fh );

// get the ticker symbol from the file

sym = StrExtract( line, 0 );

// if ticker matches current symbol

if ( Name() == sym )

{

// extract data from line of text

trade = StrExtract( line, 1 );

trade_datetime = StrToDateTime( StrExtract( line, 2 ) );

price = StrToNum( StrExtract( line, 3 ) );

shares = StrToNum( StrExtract( line, 4 ) );

//

if ( trade == "Buy" )

{

newbuy = dt == trade_datetime;

Buy = Buy OR newbuy; // combine previous buy signals with new

BuyPrice = IIf( newbuy, price, BuyPrice );

possize = IIf( newbuy, shares, possize );

}

//

if ( trade == "Sell" )

{

newsell = dt == trade_datetime;

Sell = Sell OR newsell; // combine previous sell signals with new

SellPrice = IIf( newsell, price, SellPrice );

}

}

}

//

fclose( fh );

}

else

{

Error( "ERROR: file can not be open" );

}

//

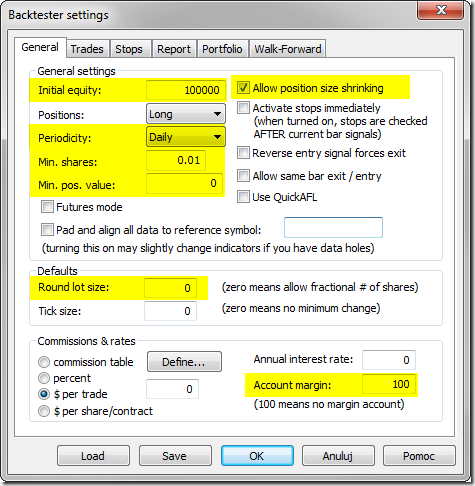

SetPositionSize( possize, spsShares );